Bitcoin (BTC), the leading cryptocurrency, has sparked extensive discourse and scrutiny across financial, technological, and legal sectors. A highly debated subject is whether Bitcoin should be categorized as a commodity. This classification not only shapes users’ perception and utilization of Bitcoin Dominance but also governs its regulation.

Thus, let’s delve into comprehending Bitcoin and its designation as a commodity.

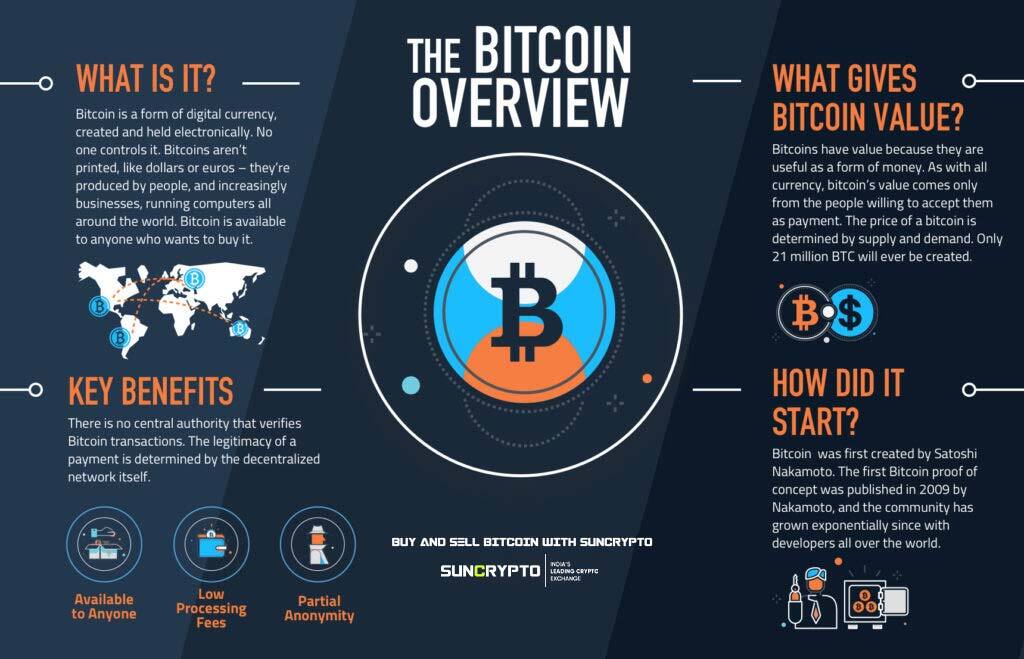

Bitcoin Dominance: What exactly is Bitcoin?

Introduced in 2009 by the enigmatic figure known as Satoshi Nakamoto, Bitcoin represents a digital asset. It operates in a decentralized manner, detached from the control of governmental or financial entities. Transactions involving Bitcoin occur through a peer-to-peer network, with each transaction recorded on a publicly accessible ledger referred to as the blockchain.

Furthermore, this groundbreaking digital asset functions as both a medium of exchange and a store of value. Nevertheless, due to Bitcoin’s volatile nature, comparisons to commodities have been drawn, sparking an ongoing discussion concerning its classification.

Bitcoin Dominance and the Discourse on Being a Commodity

The term “commodity” pertains to fundamental goods or resources that are tradable. These often encompass natural resources like gold, oil, and agricultural products. They are generally interchangeable with similar items and their value is influenced by supply and demand dynamics.

Bitcoin shares various parallels with commodities, prompting some entities, including the U.S. Commodity Futures Trading Commission (CFTC), to categorize Bitcoin as a commodity. These similarities encompass:

▪️ Robustness: Comparable to commodities, Bitcoin is a durable asset that can be stored over extended periods without losing its value.

▪️ Portability: Like commodities, Bitcoin can be easily transported from one location to another. In fact, its digital nature might make it even more portable than physical commodities.

▪️ Interchangeability: Bitcoin dominance is fungible, meaning each unit is identical and interchangeable with any other unit, akin to commodities.

▪️ Verifiability: Bitcoin transactions can be publicly recorded and readily verified on the blockchain, paralleling commodities traded on public exchanges.

Bitcoin’s Classification: Is it Genuinely a Commodity?

The classification of Bitcoin as a commodity holds significant ramifications, particularly in terms of regulatory oversight. The CFTC, responsible for supervising commodity markets, has officially designated Bitcoin as a commodity within its jurisdiction. This decision legitimizes Bitcoin dominance as a tradable asset and subjects it to CFTC regulations.

However, the classification of BTC as a commodity is not without controversy. The Securities and Exchange Commission (SEC), for instance, regards many cryptocurrencies as securities under its regulatory purview. This divergence underscores the ongoing debate and the regulatory ambiguity surrounding Bitcoin’s classification.

However, the classification of BTC as a commodity is not without controversy. The Securities and Exchange Commission (SEC), for instance, regards many cryptocurrencies as securities under its regulatory purview. This divergence underscores the ongoing debate and the regulatory ambiguity surrounding Bitcoin’s classification.

The CFTC’s Standpoint and Bitcoin

In a conversation with Christopher Giancarlo, former chairman of the CFTC, he expressed the view that BTC behaves more akin to a commodity than a security. He likened Bitcoin to commodities such as oil, wheat, or minerals, which are produced by multiple entities and then circulated publicly. Given its decentralized nature, Bitcoin exhibits these characteristics.

During Giancarlo’s leadership, the CFTC approved the first US-regulated market for Bitcoin Futures. This action further cemented Bitcoin’s categorization as a commodity and subjected it to CFTC oversight.

Differing Outlooks: CFTC vs. SEC

While the CFTC perceives Bitcoin as a commodity, the SEC holds a contrasting perspective. The SEC regards most crypto assets, excluding Bitcoin, as securities. Gary Gensler, Chair of the SEC, emphasizes the necessity for crypto exchanges and intermediaries to adhere to traditional financial market regulations.

Moreover, the contrast in stances between these prominent U.S. governmental agencies underscores the intricacy of classifying cryptocurrencies and the requirement for regulatory clarity.

The incomplete definition of a commodity

Defining a commodity is not devoid of challenges. The U.S. Commodity Exchange Act (CEA) presents a broad list of commodities, but it excludes Bitcoin and other virtual currencies. Nevertheless, the CFTC identified BTC as a commodity in 2015 due to its functional parallels with commodities.

Bitcoin’s Influence on the Future of Commodities

The classification of BTC as a commodity has ignited a transformation in the commodities sector. Often dubbed “digital gold,” the Bitcoin dominance further underscores its resemblance to commodities. Its scarcity, durability, portability, and value storage align with conventional commodity traits.

Furthermore, BTC’s classification as a commodity paves the way for other cryptocurrencies to gain similar recognition. In fact, the CFTC has already declared Bitcoin and Ether as commodities, suggesting that other cryptocurrencies may follow suit.

Implications of Regulatory Advancements

Regulatory bodies strive to match the rapid evolution of the digital realm. The recent introduction of the Responsible Financial Innovation Act aims to establish a comprehensive regulatory framework for digital assets, including cryptocurrencies.

Furthermore, this move toward more stringent regulation signifies the growing acceptance of cryptocurrencies as a legitimate asset class, whether as securities, commodities, or a novel category.

Nevertheless, government officials already face challenges in navigating their personal financial involvement with cryptocurrencies. As these digital assets become further entrenched in daily life, comprehending the regulations that oversee public officials’ interactions with them becomes increasingly vital.

Conclusion

While the discourse on whether Bitcoin qualifies as a commodity continues, it’s evident that BTC bears numerous traits resembling traditional commodities. Its durability, portability, interchangeability, and verifiability align it closely with commodities like gold and oil. As regulatory entities grapple with Bitcoin and its implications, the undeniable truth emerges that this transformative digital asset is reshaping the commodities landscape.

Amid our journey into the digital future, grasping Bitcoin dominance and its classification as a commodity remains pivotal. Moreover, the swiftly evolving crypto landscape underscores the necessity of staying informed about these advancements to comprehend the future of finance.

To learn more about Bitcoin Dominance, go check out SunCrypto Academy.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. All content provided is for informational purposes only, and shall not be relied upon as financial/investment advice. Opinions shared, if any, are only shared for information and education purposes. Although the best efforts have been made to ensure all information is accurate and up to date, occasionally unintended errors or misprints may occur. We recommend you please do your own research or consult an expert before making any investment decision. You may write to us at [email protected].