Bitcoin (BTC), being a relatively young and profoundly groundbreaking financial asset, has embarked upon a truly remarkable and unprecedented trajectory of exponential expansion and development. As a result, Bitcoin has risen to the tenth spot on the World’s Biggest Companies list virtually.

Ever since its advent in the year 2009, this revolutionary form of decentralized digital currency has captivated the hearts and minds of not only astute investors seeking lucrative opportunities but also visionary technologists and passionate enthusiasts.

In the past few years, Bitcoin has revolutionized and redefined the very fabric of the financial domain. They introduced innovative concepts that challenge age-old conventions surrounding the very nature and essence of monetary systems.

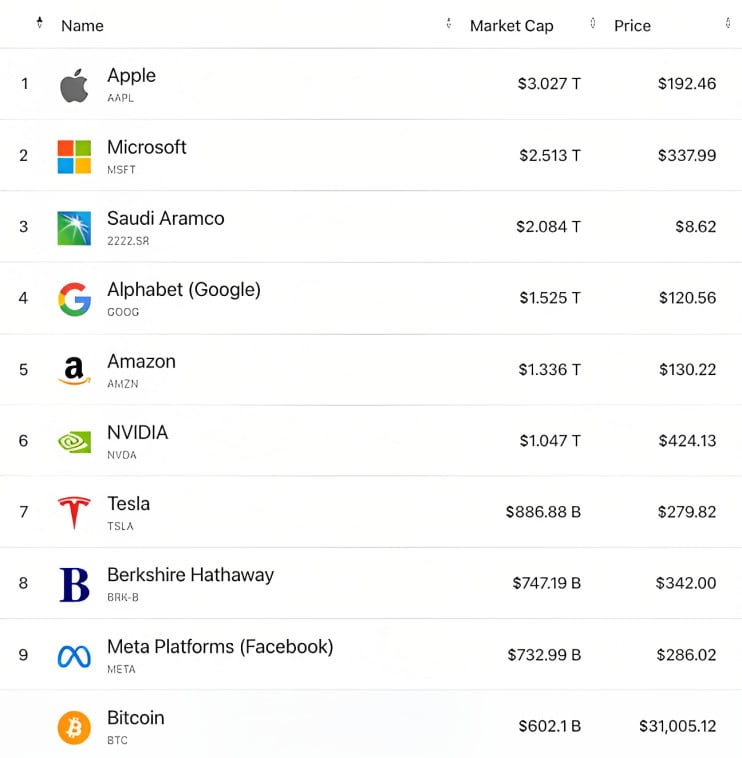

Bitcoin Ranks 10th in the World’s Biggest Companies List

BTC’s market cap currently stands at approximately $600 billion (₹48 Trillion) as of July 5, owing to its remarkable growth. If Bitcoin were a company, it would rank as the world’s 10th-largest business in terms of market valuation. The rank of BTC is trailing only behind Meta Platforms ($732 billion), Berkshire Hathaway ($747 billion), Tesla ($887 billion), and Nvidia ($1.04 trillion).

Source: Finbold

It is worth noting that Bitcoin, launched in 2009, is the youngest asset on this list. For example, Apple, the largest company globally, was founded in 1976. Similarly, Microsoft began its journey in 1975, while Tesla, Meta, and Alphabet were established in 2003, 2004, and 1998, respectively.

Furthermore, during the bull run in late 2021, Bitcoin achieved an all-time high market cap of approximately $1.2 billion, which is double its current market cap of $602 million. At that time, Bitcoin’s price reached nearly $69,000, driving its market valuation beyond $1.2 trillion.

Meanwhile, several significant institutional investors, including BlackRock and Fidelity Investments, have recently submitted applications to launch spot Bitcoin exchange-traded funds (ETFs). If approved, this would grant US investors direct access to BTC through some of the largest Wall Street giants, likely bolstering institutional adoption.

Considering that Bitcoin has yet to witness mainstream adoption and assuming it surpasses its previous record highs, it has the potential to become one of the most valuable financial assets globally.

Bitcoin (BTC) Price Outlook

Just before the end of the weekly trade, the BTC price set up a significant rise, which was spurred further by large institutions entering the crypto sector. Since the price hit ₹24,60,000, the trend has begun to trade sideways inside a set range. The analysts project that the price will remain consolidated during the week, with volatility increasing as the weekend approaches.

At the time of writing, the price of Bitcoin is trading at ₹2,509,968, decreasing by more than 1.5% in the past 24 hours. Despite a noteworthy bearish action that may hinder the rally, experts believe the price will maintain an ascending consolidation and remain over $31,500.

Conclusion

Emerging as a true force to be reckoned with, Bitcoin (BTC) has now virtually claimed a spot among the world’s largest companies. By securing the tenth position on the esteemed World’s Biggest Companies List. This decentralized digital currency has captivated the imagination of investors, technologists, and enthusiasts alike.

With a market cap of approximately $600 billion, Bitcoin has revolutionized the financial domain. By challenging long-standing conventions and reshaping the nature of money itself. As Bitcoin continues to gain mainstream attention and attract institutional investors, its remarkable growth trajectory positions it as a potentially invaluable global asset.

To know more about the World’s Biggest Companies List, go check out SunCrypto Academy.

Disclaimer: Crypto products and NFTs are unregulated and can be highly risky. There may be no regulatory recourse for any loss from such transactions. We provide all content for informational purposes only, and you should not rely on it as financial/investment advice. We share opinions, if any, only for information and education purposes. Although we have made our best efforts to ensure all information is accurate and up to date, occasionally unintended errors or misprints may occur. We recommend you to please do your own research or consult an expert before making any investment decision. You may write to us at [email protected].